CRESTVIEW — A proposed fire services fee that could add hundreds of dollars to residential water bills and cost some businesses almost double their property taxes doesn't sit well with Councilwoman Robyn Helt.

The Crestview Fire Department could fund its $3.5 million annual budget by monthly assessing as much as $28.16 to every city residence, according to Tallahassee-based Government Services Group consultants.

Businesses, institutions and commercial properties would receive square foot assessments. An 8,000 square-foot commercial property could be assessed as much as $1,760 atop its annual tax bill.

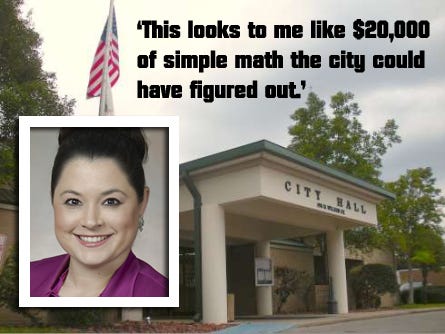

‘$20,000 OF SIMPLE MATH’

Helt took issue with the $20,000 cost of the report, which, GSG senior project manager Jeff Rackley said, was based on data from the fire department and city clerk’s office.

“Honestly, all of that is information the city has at its disposal any given day,” Helt said. “This looks to me like $20,000 of simple math the city could have figured out.”

By using GSG’s methodology, which Rackley said the Florida Supreme Court has accepted in previous cases, the city could avoid challenges to the levy of the additional fee, Fire Chief Joe Traylor said during a Wednesday workshop.

BUSINESS DETERRENT

The proposed fire assessment would deter business growth, Helt contended. For example, based on the Crestview Wal-Mart’s 200,000 square footage, its fire assessment would be $54,000 a year, substantially higher than its 2013 $29,586 city tax bill, she said.

The assessment would undo the council’s efforts, such as eliminating some impact fees, to lure businesses to town, Helt said.

“For a TJ Maxx or a Ross, that would be cost-prohibitive and make them look elsewhere if they are considering Crestview,” Helt said. “And what about the mom-and-pop start-ups?”

Councilman Tom Gordon said his interest in the fee was that it would spread the cost of fire protection equitably over all property owners and lower the millage rate for tax-paying homeowners.

“The only way I can support the assessment is if it gives the taxpayer an overall lower cost of living in the city of Crestview,” Gordon said. “If you cause the cost of business to go up where there is no ad valorem rate adjustment, they’ll raise prices or go somewhere else.”

FAIRNESS FOR ALL

Council President Shannon Hayes agreed with assessing all property owners, saying 57 percent of homeowners pay no city taxes.

“These people who have been getting a free ride for years and years and years are finally going to have the opportunity to contribute their fair amount,” Hayes said.

“Let’s talk about the 57 percent,” Helt said. “Some are retired or disabled; they have practiced fiscal restraint. …We shouldn’t look for loopholes to get around protections like the homestead exemption.”

Helt advocated the city “reduce spending and increase efficiencies” instead of adding more to residents’ tax burden.

“Just this one report alone cost $20,000 for very simple math that we could very easily come up with on our own,” she said.

Email News Bulletin Staff Writer Brian Hughes, follow him on Twitter or call 850-682-6524.

This article originally appeared on Crestview News Bulletin: Helt questions Crestview's proposed fire assessment fee