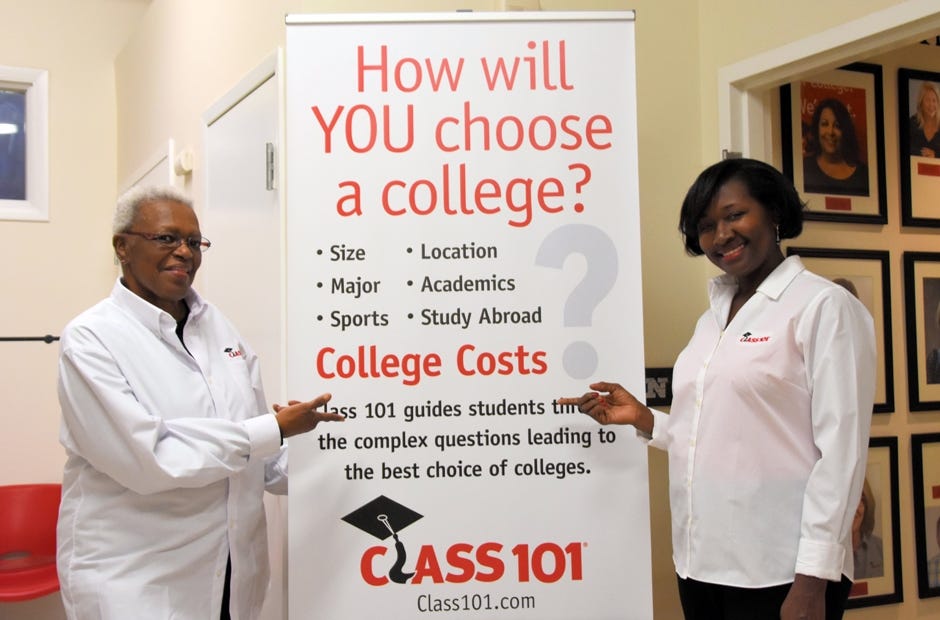

![Dr. Naomi Barnes, left, and Dr. Patrice Williams-Shuford are providing assistance with college options to Northwest Florida parents and students. [SPECIAL TO THE NEWS BULLETIN]](http://127.0.0.1/wordpress/wp-content/uploads/2022/01/ghows-DA-7f95f363-bcca-68ed-e053-0100007fae44-f10be7b4.jpeg)

CRESTVIEW — When navigating the college planning process, most parents need to do a little homework themselves when it comes to finding financial assistance options.

Class 101, a national franchise that now has a local option in Crestview, can help. The organization helps high school students get into better colleges and qualify for more scholarships and financial aid.

“Often, federal financial aid forms are filled out incorrectly or families think they earn too much for their kids to be eligible,” Dr. Naomi G. Barnes said. She is co-owner of the new Class 101 Blackwater franchise in Crestview.

“Data kept by the Free Application for Federal Student Aid program (FAFSA) shows that as many as 90 percent of applicants make mistakes when filling out these forms,” Barnes said. “It’s no surprise, because the forms can be more difficult to complete than filing tax forms.”

FAFSA is just the tip of the iceberg for finding potential funds, Barnes's business partner, Dr. Patrice A. Williams-Shuford, said.

“Many scholarships are available based on students’ skills and interests. Students need to think about their strengths and things they love, then search for scholarships that are targeted for these strengths,” she said.

The Blackwater Class 101 location also offers career assessments to help students identify their interests and potential majors, and then guides them toward identifying potential scholarships that match their personal circumstances.

Here are five most common mistakes on scholarship forms:

- Entering the wrong Social Security number,

- Neglecting to sign the electronic FAFSA form. (An electronic PIN must be obtained prior to completing the FAFSA.) This PIN serves as a parent’s signature,

- Listing student income and assets – the lower the better. The student must earn less than $3,000.

- Listing assets not relevant to the FAFSA application process, like equity in a home and retirement account, neither of which is considered an asset by the FAFSA program,

- Misunderstanding FAFSA eligibility. Once again, many parents think they make too much money to qualify for help.

Barnes and Williams-Shuford have had expansive careers as educators and are excited to be bringing their years of expertise to students and their parents.

This article originally appeared on Crestview News Bulletin: Northwest Florida educators offer help with college planning