A new national report ranking Florida's business climate as 5th best in the nation highlights the state's strengths but may overstate the attractiveness of Florida's tax system, according to Florida TaxWatch. The ranking is from the Tax Foundation's 2015 Business Tax Climate Index, an annual publication that analyzes how tax structures compare across states.

"Florida's tax structure is one of the many factors that makes Florida a good place to do business," said Dominic M. Calabro, President and CEO of Florida TaxWatch. "However, there is always room for improvement. Instead of focusing on Florida's 5th place ranking, policymakers should look at where they can make needed reforms to help welcome additional capital, more jobs, and further economic growth to the Sunshine State."

Florida is the only large state appearing in the top five, while rival Texas received a 10th place score. California, New York and New Jersey were judged to have the worst tax climates.

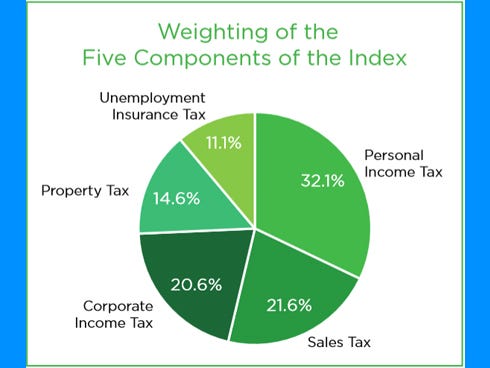

Florida's lofty ranking is largely due to its not having a personal income tax, the most heavily weighted tax in the Index.

While Florida receives high scores in all tax categories, the Florida TaxWatch report notes that the property and sales tax rankings may be overstated. Florida's property tax structure shifts burden to non-homestead properties, including businesses. Florida's high sales and excise taxes rate and its taxes on commercial leases, communications, and non-residential electricity may not be adequately reflected in the state's sales tax ranking of 12.

"Other states are taking significant steps to improve their business tax climate," said Kurt Wenner, Vice President of Tax Research for Florida TaxWatch. "Florida lawmakers have an opportunity to use the tax ranking information to address real tax reform in our state, such as reducing or eliminating the sales tax on commercial leases, reducing the communications services tax, eliminating the tangible personal property tax, and collecting lawfully owed sales and use taxes on internet purchases."

This article originally appeared on Crestview News Bulletin: Here's why Florida's business tax climate is 5th in the nation (FILE)