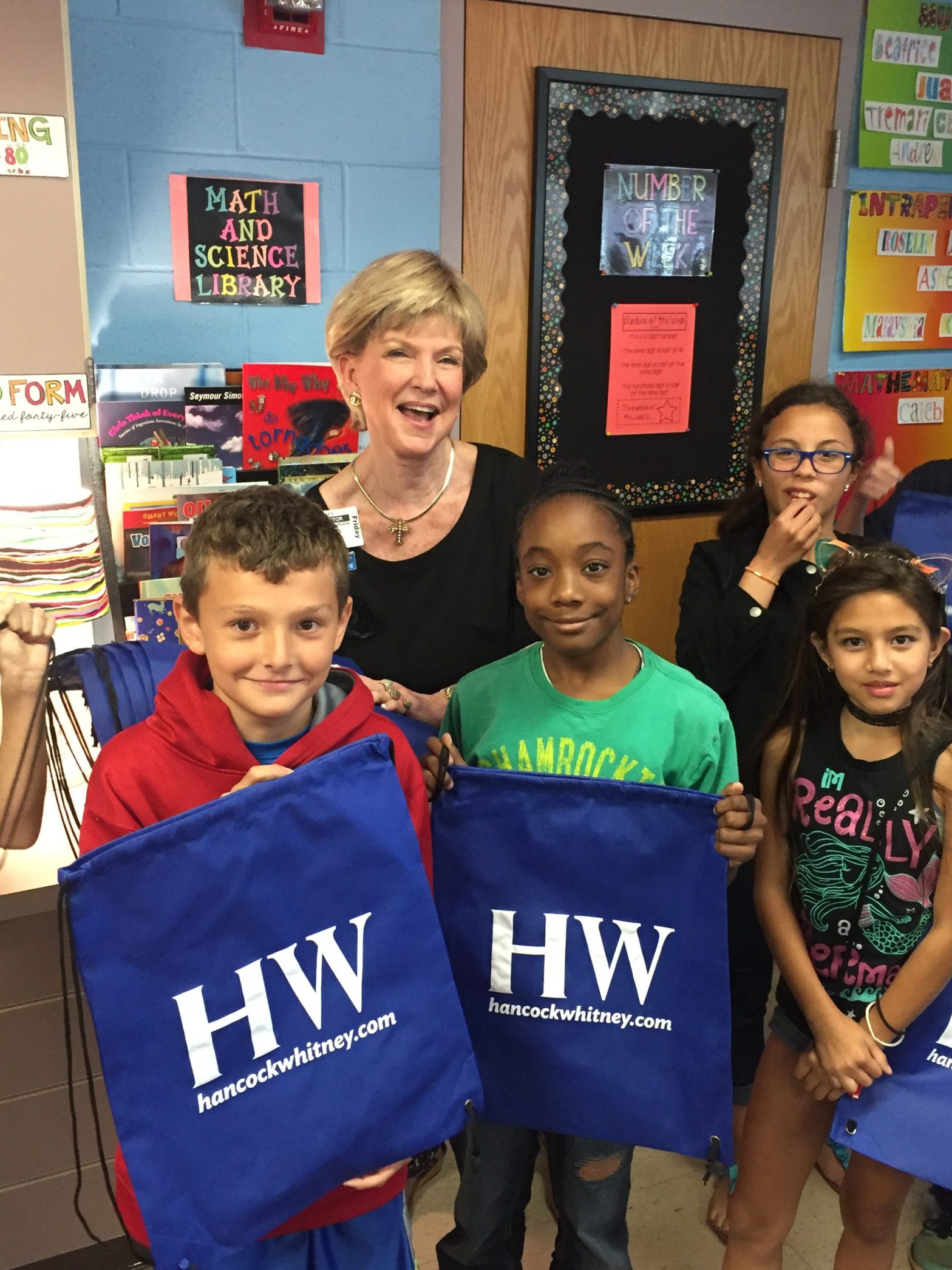

![Bob Sikes Elementary School students on Friday experienced Hancock Whitney Financial Cents, an award-winning financial education series powered by EVERFI. [Special to the News Bulletin]](http://127.0.0.1/wordpress/wp-content/uploads/2022/01/ghows-DA-5cad530f-8053-0a3a-e053-0100007fdb1e-877b8dd1-scaled.jpeg)

CRESTVIEW — Nearly nine years after the financial crisis that rocked Wall Street and Main Street, studies show Americans still want and need solid financial knowledge, especially for their children.

Hancock and Whitney Bank, along with EVERFI, Inc., an education technology firm, are launching financial education to empower local students with the money savvy they need using digital tools they already embrace.

On Friday, the bank kicked off Hancock Whitney Financial Cents, its award-winning year-round financial education series powered by EVERFI, at Bob Sikes Elementary School. Hancock Whitney’s financial education efforts in October tied to the bank’s Founders Day, celebrating the shared birth month for both banks' brands and its century-old pledge to help people succeed.

“In October in the 1800s, our founders committed to creating opportunities for people and the communities we serve,” said Market President Bruce Vredenburg. “Since then, financial education has been a priority for us. We believe if people — especially students — can learn and practice good financial habits now, they’re better prepared to build financial security and create opportunities for themselves, their families, and communities. We chose to make Founders Day about financial education to honor our heritage and meet our mission to help people achieve their financial goals and dreams.”

For two years, Hancock Whitney’s commitment to financial education has earned the EVERFI Financial Capability Innovation Award at the NASDAQ MarketSite in New York City for significant contributions to improving American’s financial capabilities through distinctive digital learning initiatives.

About Financial Cents

The web based Hancock Whitney Financial Cents for elementary, middle and high school students uses the latest in simulation and game technologies to make complex financial concepts easier and fun to learn. Engaging, interactive, common-sense money management modules reinforce classroom teaching, support state requirements, and come at no cost to schools, districts or taxpayers.

Financial Cents topics include savings, credit scores, insurance, credit cards, student loans, mortgages, taxes, stocks, 401(k)s and other critical concepts aligned with national financial literacy standards.

Since 2014 Financial Cents has reached nearly 39,000 students at almost 250 schools, with more than 201,100 modules and 150,830-plus learning hours.

Why 'financial ed’ matters

A 2015 Financial Industry Regulatory Authority National Financial Capability study revealed Americans have gotten better about money management since 2009, but concerns about overall financial capabilities still linger.

While 81 percent of respondents gave themselves pats on the backs for how well they handle day-to-day financial matters, those able to answer at least four of five basic financial literacy questions correctly took a downward turn. Of the ones with the most positive perceptions about their own money smarts, nearly 30 percent incurred credit card costs such as interest or fees for late payments, over-the-limit charges, and cash advances. Twelve percent overdrew their checking accounts.

Americans could still save more, too. Only 50 percent have “rainy day” stashes of the recommended three months’ living expenses for emergencies. Thirty-four percent could not come up with $2,000 for unexpected expenses; and more than one in five had unpaid health care bills. Only 39 percent have attempted to figure how much to save for retirement, and more than half worry about running out of money in retirement.

In general, younger Americans lack key financial capabilities, too.

How Financial Cents helps

Hancock Whitney Financial Cents can fill the knowledge gaps. According to a 2016 EVERFI survey, parents want their kids to learn about money. Eighty-six percent of parents regularly talk about money with their children, but only 43 percent feel “well prepared” to teach their children personal finance. Additionally, credit scores, emergency funds, and investing and growing wealth are almost always absent from those family financial conversations.

Stressing the practical side and lifelong benefits of understanding money, Financial Cents can expand family insights, broaden learning scopes, complement classroom teaching, and incorporate familiar technology to show students how to apply essential financial skills.

This article originally appeared on Crestview News Bulletin: Bank offers 'Financial Ed’ at Bob Sikes Elementary