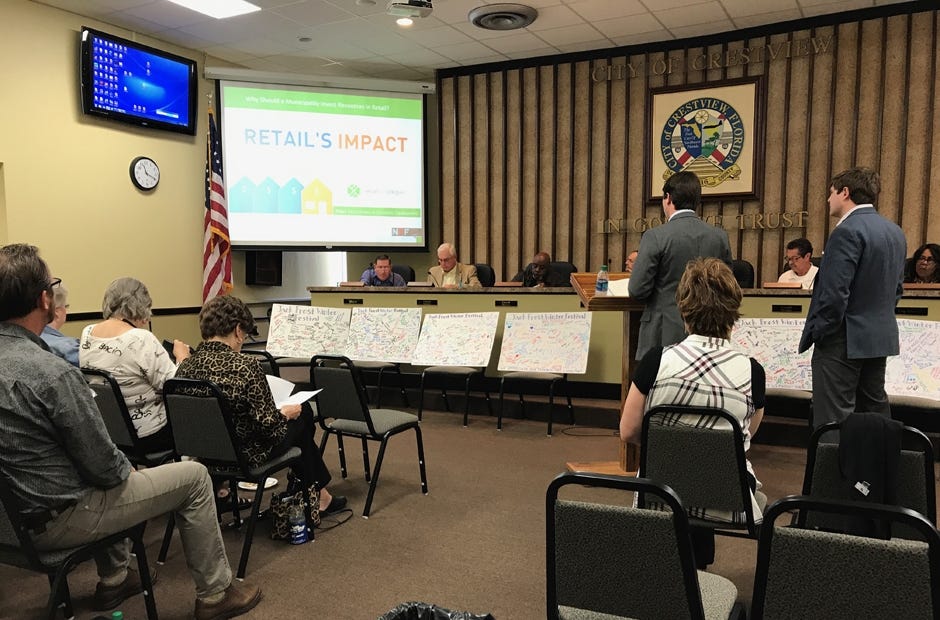

![Scott vonCannon (left at podium) and Joe Strauss (right at podium) of Retail Strategies present Crestview Community Redevelopment Agency an assesment and plan for marketing the city to potential retailers. [MARK JUDSON/NEWS BULLETIN]](http://127.0.0.1/wordpress/wp-content/uploads/2022/01/ghows-DA-4bcfd7f1-637b-42da-e053-0100007fcb55-50bac13b.jpeg)

CRESTVIEW — Retail Strategies presented a retail recruitment and area assessment to the city’s Community Redevelopment Agency on Thursday.

The company gave an overview of its findings during the first phase of helping Crestview lure retail and restaurant establishments to the area.

CRUNCHING THE NUMBERS

The CRA hired Retail Strategies in October to study Crestview’s viability for new businesses. The firm is a liaison between cities, retail establishments and developers with a goal to connect businesses that can best integrate into the community.

A common misconception is that city leaders dictate what businesses open in the area. However, the respective companies decide what market to move to and groups like Retail Strategies help provide the city with tools to gain those businesses’ attention.

The group spent several months collecting data on Crestview and generated over 23,000 metric variables to interpret.

“Why can’t we get a Target?” is a primary question asked around town. The short answer is that it’s not likely to happen in the immediate future due to Target’s current business plans.

That’s not to say the city has little hope for development.

“The data we’ve looked over and the feedback we’ve received from potential retail outlets has been great,” Portfolio Director Scott vonCannon said.

Retail Strategies has identified about 100 companies that could integrate and succeed in Crestview. He didn’t wish to discuss specific businesses publicly due to the nature of negotiations and the fear of rumor spreading before deals are made.

Councilman and CRA Board Member Bill Cox cited multiple pieces of data compiled by Retail Strategies that he believed might be outdated or skewed, such as the average household property value and income.

vonCannon was open to discuss the matters with the board at a later time but didn’t directly address where those discrepancies might have arisen from.

The data has a margin of error between 3 and 4 percent, according to vonCannon, but potential miscalculations identified by Cox far exceed that amount.

WHAT CAN CRESTVIEW LURE?

“[Target] is looking for a higher range and income in the trade area,” vonCannon said.

The trade area is compiled by using mobile location data to determine how far people will travel for goods or services.

Walmart, for example, not only draws from the Crestview population but other surrounding areas. Using this location data, Retail Strategies was able to compile a “trade area” population that a potential retailer can pull from.

Crestview’s trade area is just under 90,000 people, but it’s expected to grow within the next five years. Target looks for a trade area of about 200,000-250,000, according to vonCannon.

The company is also shifting from “big box” stores to smaller, urban developments in metropolitan cities.

The same can be said for other box department stores and sit-down restaurants like Red Lobster or Olive Garden.

MILLENNIAL-FRIENDLY TRENDS

“Some of these retailers are ones of the past,” vonCannon said. Those businesses have been in decline and store openings are rare, if happening at all.

What is growing are fast-casual dining locations (Moe’s, Panera, Firehouse Subs), specialty grocery stores that service a select community like organic or ethnic foods (Whole Foods, Aldi), apparel stores (Ross, Rue 21) and fitness clubs (LA Fitness, Pure Barre).

These industries adapted to more modern business models after the recession and the shift to majority millennial consumers, according to vonCannon. These forms of business will be more likely to move to Crestview and thrive.

Councilman and CRA Board Member Doug Faircloth expressed concern that the researchers were placing too much emphasis on vehicle counts in certain areas. These counts estimate the number of cars that pass a given area in a set time, typically a single day.

“Build it and they will come,” Faircloth said. “Maybe traffic count would increase if there was a retailer there.”

“Low vehicle counts increase the risk,” vonCannon said. “Not every retailer has the pull to bring vehicles like Walmart does. All it is to [developers and investors] is limiting risk.”

WHAT’S NEXT?

The next step, phase two, will be to execute recruitment of retailers and developers that data has determined to be feasible, for both the city and the respective company, according to vonCannon.

Retail Strategies now has the information it needs to approach these selected retailers through consultations and national real estate conferences to market Crestview, vonCannon said.

Each company has a different timeline for how long it takes to decide on a location, prepare plans, construct and open. The best-case scenario for any company is about six months, vonCannon said. However, the process is typically much slower.

“A company like Target might say, ‘We’re going to open 40 stores this year,’ and might have 1,000 cities that want one and fit their criteria,” vonCannon said. “They pick the 40 that are easiest for them to move into. Our goal is to put Crestview in that top list so when retailers do decide to open new locations, this is one of them.”

Retail Strategies will cost about $30,000 per year for continued services, which comes from the CRA annual budget.

This article originally appeared on Crestview News Bulletin: Crestview receives data, plans to lure businesses